Coalition apologists are oft want to lambast Labor for over-spending. Yet why the Coalition runs a surplus with our tax money is questionable, when it would be better off either spent on bettering services and infrastructure or returned to us.

Coalition apologists are oft want to lambast Labor for over-spending. Yet why the Coalition runs a surplus with our tax money is questionable, when it would be better off either spent on bettering services and infrastructure or returned to us.

Lindsay Tanner is demonstrating already that Labor is committed to reducing wasteful expenditures and trimming sleazy Howard pork. Of particular note are much needed funding slashes to the virulent, profligate government propaganda machine, tax deductability of cronies’ political donations and curtailment of organisational perks.

LINDSAY TANNER MP

SHADOW MINISTER FOR FINANCE

LABOR’S $3 BILLION SAVINGS PLAN

Federal Labor today announced a massive savings plan to cut out $3 billion of Howard Government waste.

These $3 billion in savings across the 4 years of the federal budget will put downward pressure on inflation and interest rates.

Labor’s savings plan includes:

· Saving $394 million by scrapping the Howard Government’s extreme work laws;

· Cutting $350 million worth of Howard Government political advertising; and

· A $395 million cut in the use of consultants in the Commonwealth public service.

A Rudd Labor Government will use its $3 billion savings plan to cut wasteful spending and increase investment in productivity drivers like education, skills and infrastructure.

Complacency and lack of discipline by the Howard Government has allowed unnecessary spending to flourish. Splurges of taxpayers dollars on political advertising and high cost consultants are proof of that fact.

If introduced today, Labor’s savings would save $3 billion over the Budget estimates period. Labor will continue to pursue savings options, and make further savings announcements prior to the election.

This sensible and disciplined savings plan will put downward pressure on inflation and interest rates. Labor’s savings include and build on the $1 billion of savings announced in November 2006

2 March 2007

SUMMARY OF LABOR’S SAVINGS

Figures in $million 2006-07 2007-08 2008-09 2009-10 Total

Limit FTB (B) to those who earn under $250,000 7.5 7.5 7.5 22.5

Withdraw Australia’s contribution to the European Bank for Reconstruction and Development 88.0 88.0

Remove tax deductibility for political donations 9.5 11.6 21.1

Remove surplus funding due to WorkChoices 53.5 138.2 141.7 61.4 394.8

Fold Invest Australia functions into Austrade 23.5 23.5 23.5 70.5

Reverse 2006 Budget measure for on-line electronic authentication 4.0 12.6 9.1 25.7

Abandon Medibank Private sale and associated sale costs 12.0 12.0

Reverse increase in MP’s printing allowance 2.0 5.0 5.0 5.0 17.0

Require industry to fund the Financial Literacy Foundation 5.3 5.4 10.7

Streamline government advertising and eliminate political propaganda 50.0 100.0 100.0 100.0 350.0

Abolish Prime Minister’s Community Business Partnership 2.0 4.3 6.3

Use centralised telephone services and websites to advise on aged care availability and save uncommitted Carelink funds 13.7 13.7

Require industry not taxpayers to fund the Do Not Call Register 4.0 10.1 7.6 6.2 27.9

Partially reverse 2006-07 Budget decision giving extra running costs to the Department of Foreign Affairs and Trade 4.5 8.5 8.9 9.4 31.3

Reverse 2006-07 budget decisions to increase Australian Securities and Investment Commission funding 19.3 36.7 36.8 37.0 129.8

Defer Access Card for further examination 145.0 157.0 302.0

Abolish Carrick Institute awards and reduce Institute funding 5.4 10.7 10.7 10.7 37.5

Absorb the cost of the Future Fund advisory unit 0.4 0.7 0.7 0.7 2.5

Reduce spending on non-Defence related recruitment agencies 7.0 15.8 15.8 15.8 54.4

Reduce spending on consultants 56.5 112.9 112.9 112.9 395.2

Reduce spending on political opinion polls/market research 7.5 15.0 15.0 15.0 52.5

Reverse December 2006 decision to create Digital Australia and increase ACMA funding 2.9 7.0 5.9 6.2 22.0

Remove funding to employers to promote WorkChoices under the Employer Advisor Program 12.5 12.5

Remove December 2006 funding increase for the PM’s Nuclear Energy Taskforce 3.9 3.9

Improve purchasing and administration arrangements of Commonwealth air travel 6.0 15.0 15.0 15.0 52.5

Reduce funding for the National Capital Authority 1.0 3.5 3.5 3.5 11.5

Reduce duplication in tax administration by abolishing the Inspector-General of Taxation 2.2 2.2 2.2 6.6

Extend Centrelink compliance campaign – ‘Keeping the system fair’ 51.8 53.4 55.0 160.2

Redirect 2006-07 budget measure to increase Australian Taxation Office funding to compliance activity to produce larger compliance dividend 7.0 62.1 175.7 235.7 480.5

Re-introduce the voluntary Student Supplement Scheme saving money in youth allowance and AUSTUDY 34.7 31.3 28.1 94.1

Reverse December 2006 decision for National Training Centre for Aerial Skiing 2.5 2.5

Close Nauru and Manus Island detention centres 10.0 27.0 27.0 27.0 91.0

Total # 275.4 943.1 994.8 789.4 3001.2

# Labor’s November savings announcement included $125 million arising from the proposed withdrawal of Australian troops from Iraq. Following questioning in estimates, no clarity was given of the Government’s actual funding in the forward estimates. Although the Government has no exit strategy from Iraq, it has not provided forward estimates of the cost of troop deployment beyond 30 June 2007. Labor will withdraw Australian combat troops from Iraq, but it is difficult to estimate the savings from the withdrawal of troops because of the lack of transparency relating to these costs in the forward estimates, as well as the fact that the precise timing of the withdrawal will be subject to the stage that the combat troop rotation has reached and negotiations with the United States and Iraqi Governments on a staged withdrawal. Therefore the savings from the withdrawal of combat troops cannot be included in this savings package.

My goodness, what will the aerial skiers say?

Angry and embarrassed, Howard accepts Santoro’s resignation – in the light of previous resistance exemplified by a declaration that Santoro’s lapse of memory was a mistake, not a sackable offence, we are left in no doubt that the prime monster’s vaunted code of ministerial conduct has been garish window-dressing to cover up shameless debauched hypocrisy.

Angry and embarrassed, Howard accepts Santoro’s resignation – in the light of previous resistance exemplified by a declaration that Santoro’s lapse of memory was a mistake, not a sackable offence, we are left in no doubt that the prime monster’s vaunted code of ministerial conduct has been garish window-dressing to cover up shameless debauched hypocrisy.

Who wouldn’t like to have been a cashed up Chinese investor this year, rolling in US dollars, eager to drop them into cheap physical resources as the United Stupids economy sags under the weight of precarious hedge and subprime mortage funds and a tenuous bond market?

Who wouldn’t like to have been a cashed up Chinese investor this year, rolling in US dollars, eager to drop them into cheap physical resources as the United Stupids economy sags under the weight of precarious hedge and subprime mortage funds and a tenuous bond market?  Coalition apologists are oft want to lambast Labor for over-spending. Yet why the Coalition runs a surplus with our tax money is questionable, when it would be better off either spent on bettering services and infrastructure or returned to us.

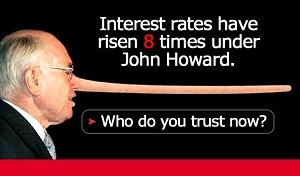

Coalition apologists are oft want to lambast Labor for over-spending. Yet why the Coalition runs a surplus with our tax money is questionable, when it would be better off either spent on bettering services and infrastructure or returned to us. Adulators of our prime monster often pontificate about the proud, supposedly unequalled record of the object of their worship in keeping interest rates under control. Yet as it can easily be demonstrated, they are indulging in pompous magical thinking.

Adulators of our prime monster often pontificate about the proud, supposedly unequalled record of the object of their worship in keeping interest rates under control. Yet as it can easily be demonstrated, they are indulging in pompous magical thinking. Mewling net nanny Helen Coonan has been pushing the

Mewling net nanny Helen Coonan has been pushing the  Still, one might regard this libtrog piece of wowserism as a flailing last ditch attempt to jerk public interest back to good old safe rightard family values and away from the embarrassing “Who’s Helped the Most Crooks and Who Has the Most Crooks” sacrificial chess game which little Johnny looks to be losing by a resignation or two at present.

Still, one might regard this libtrog piece of wowserism as a flailing last ditch attempt to jerk public interest back to good old safe rightard family values and away from the embarrassing “Who’s Helped the Most Crooks and Who Has the Most Crooks” sacrificial chess game which little Johnny looks to be losing by a resignation or two at present.