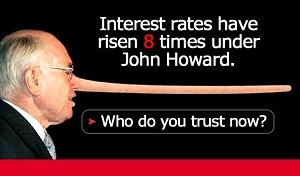

Adulators of our prime monster often pontificate about the proud, supposedly unequalled record of the object of their worship in keeping interest rates under control. Yet as it can easily be demonstrated, they are indulging in pompous magical thinking.

Adulators of our prime monster often pontificate about the proud, supposedly unequalled record of the object of their worship in keeping interest rates under control. Yet as it can easily be demonstrated, they are indulging in pompous magical thinking.

For example, from this 2006 7.30 Report:

MICHAEL BRISSENDEN: In the same interview Ian Macfarlane tested that bold claim about record high interest rates, whose rates were higher John Howard in 1982 as Treasurer or Paul Keating in 1989?

IAN MACFARLANE, FORMER RESERVE BANK GOVERNOR: The bill rate was higher in ’82 and it was higher I have to say in ’85 than ’89.

MAXINE McKEW: Perceptions are interesting, aren’t they?

Kim Beasley said last November of Johnny’s more recent deceptive record:

John Howard promised in the 2004 election to “keep interest rates at record lowsâ€, but they have risen three times since then, and seven consecutive times in all. He has betrayed the families who put him in office, and is completely out of touch with the pain his rate rises inflict on Middle Australia. Mr Howard is so out of touch, he urged the Reserve Bank to raise rates and told us it is the interest rate rise we have to have.

Globally, despite the Prime Monster touting a supposedly healthy, booming economy, Whorestralia has very high interest rates:

According to the OECD, only Turkey, Iceland, Mexico and New Zealand have higher interest rates than Australia.

Depending on the April 24 CPI figures, it is on the cards that there will be at least one more interest rate rise this year. Little Johnny will be praying he won’t have to explain away prior to this year’s crucial federal election the fifth interest rates hike since he promised at the last election to keep interest rates low.

More on Howard’s stint as Treasurer:

Lifted from seals at HC:

More interesting data from Honest John Howard’s murky past as treasurer:

And more:

Given that in the last 4 years foreign investment has increased 35%, could it be that we are about to be in for another recession we have to have, primed by higher and higher interest rates? Perhaps those who say we should vote Lib this election to force them to wear the responsibility of their fiscal irresponsibility are right.

Don’t forget, Fringe, the all time record 90-day bank bill interest rate of 21.39% occurred in April 1982 when Howard was treasurer in the Fraser government.

Makes a mockery of the constant liberal accusations about high interest rates under Labor as the highest interest rates were during Howard’s economic management.